When landlords invest in properties in California, they aim to generate profits, which are subject to taxation by both state and federal governments. Capital gains taxes apply to the increase in net worth from investments and differ from other forms of income tax. In California, landlords should consider seeking guidance from a financial advisor to strategize for these taxes and ensure optimal financial planning.

What is the Capital Gains Tax?

Capital gains refers to the profit that you make from selling an asset such as a stock or property. In the context of real estate, this is going to be the profit that you make from selling an asset higher than you paid for it. Capital gains tax distinguishes earnings from investments, contrasting with income derived from employment. Typically, income tax deductions are withheld from regular paychecks, forming the mainstay of taxation for most individuals.

Investments held for less than a year typically incur higher short-term capital gains taxes, attributed to their rapid turnover. At the federal level, they are taxed as regular income, potentially resulting in tax rates exceeding 20%, contingent upon your income bracket.

Assets held for more than a year generally trigger the long-term capital gains tax. This tax rate is typically lower than its short-term counterpart and standard income tax rates at the federal level. Similarly, certain states may apply a progressive tax structure, wherein rates increase with higher earnings, while others may impose a flat tax rate on these gains.

California Capital Gain Tax

In contrast to the federal system, California does not differentiate between short-term and long-term capital gains. It treats all capital gains as regular income, subjecting them to the same tax rates and brackets as the state’s standard income tax.

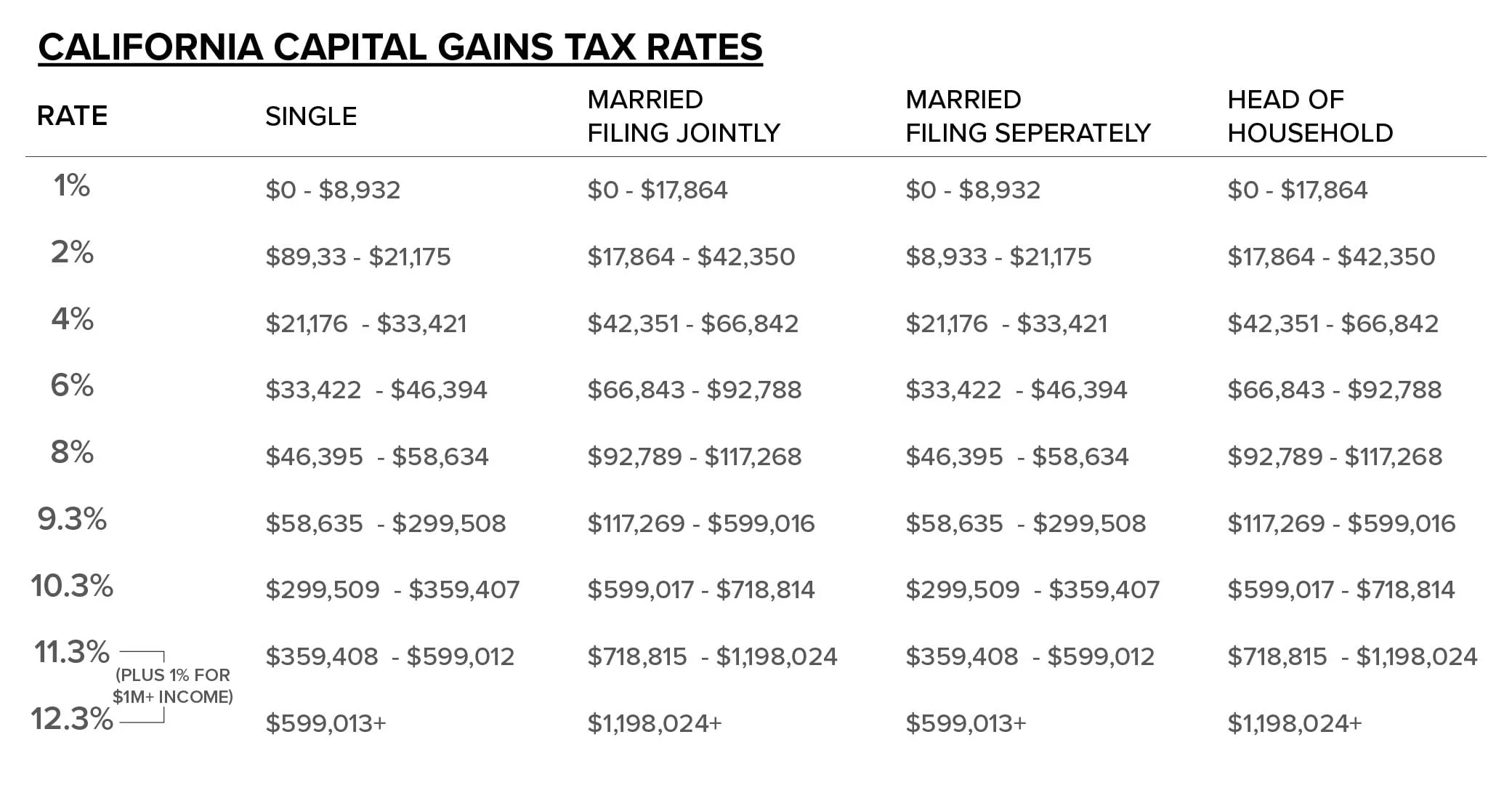

The table below illustrates the tax rates applicable to both income and capital gains in California:

How is Capital Gains Tax Calculated in California?

- Determine the Holding Period: The length of time you possess the asset before selling it significantly influences the applicable tax rate for capital gains. Assets held for over a year fall into the long-term capital gains category, while those held for a year or less are short-term capital gains.

- Determine the Cost Basis: The asset’s cost basis comprises the original purchase price along with any associated expenses like commissions and fees. Adjustments may be necessary for factors such as depreciation or asset enhancements.

- Calculate the Capital Gain: After establishing the sale price and cost basis, deduct the latter from the former to ascertain the capital gain.

- Apply the Relevant Tax Rate: In California, long-term capital gains attract different tax rates compared to short-term ones. Current information indicates long-term capital gains tax rates in California range from 0% to 13.3%, depending on the taxpayer’s income level.

- Consider Additional Factors: Certain capital gains types, such as those from real estate sales, might be subject to additional taxes or exemptions. Understanding these specific regulations and exemptions is vital for accurately assessing your capital gains tax obligations.

Understanding the California capital gains tax landscape is important for landlords= managing properties within the state. By mastering the rules and regulations of capital gains tax, landlords can strategize effectively to reduce tax burdens and optimize investment gains. From implementing tax-efficient investment tactics and leveraging exemptions, proactive tax planning will be critical in maximizing profits for your investments.